A cloud-based core built for you

CSI’s holistic core is built with your needs in mind, making it easier than ever to serve customers and boost profitability. This single, easy-to-use platform consolidates all banking data and functions to streamline operations. You’ll love its ease of use. So will your customers.

Learn more about our core

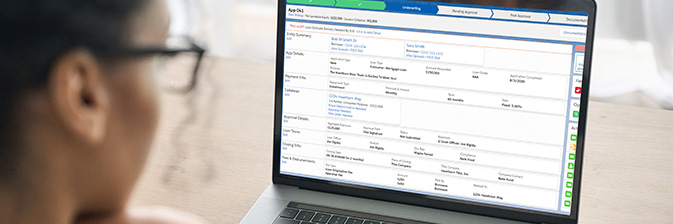

Consolidated, streamlined lending

Hawthorn River’s core-integrated loan origination solution simplifies lending operations for everyone involved. With automation, detailed analytics and a seamless digital experience, it’s designed to increase digital engagement, lending efficiency and revenue generation. Plus, our integrated loan management system allows you to track documentation, optimize interest rates, provide reminders and more from a single platform.

How our banks are diversifying lending portfolios

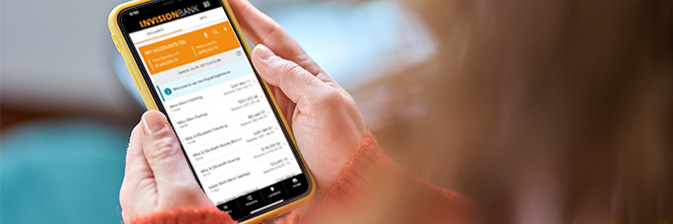

The latest in digital banking technology

Attract, onboard, engage and safeguard your customers with top-notch digital banking technologies. Our integrated digital banking solutions empower you to digitally transform your business and create a customer-centric digital experience to rival anything else on the market.

Our digital banking solutions

Lightning-fast payments processing

Revolutionize your institution’s payment infrastructure with our integrated processing solutions. Through offerings like FedNow Instant Payments, P2P, ACH, wire processing, cards and more, you can choose the fastest and most cost-effective payment rail. Ultimately, this modern approach simplifies transactions for your bank, branches, merchants and customers.

Today's digital payment trends

Flexibility and adaptability for the future

Whether you want to add new products from an already integrated fintech or develop your own CSI-integrated APIs, we’ve got you covered. CSI’s Open Banking Marketplace showcases integrated third-party solutions designed to extend your core banking platform. And our developer portal guides you to develop your own CSI-integrated solutions. By unlocking faster integration and new business models, CSI’s open banking platform will keep you adaptable and competitive for many years to come.

Explore open banking