Proactive | Integrated | Compliant

Get Ahead of the ACH Fraud Curve

As ACH fraud threats continue to escalate, financial institutions are under increasing pressure to reassess their current strategies and stay ahead of emerging risks. With Nacha’s 2026 mandate on the horizon, the urgency to act has never been greater. Now is the time to implement proactive solutions that strengthen fraud prevention capabilities, protect your customers, and minimize financial and reputational risk. The impact is clear:

- 131% growth in ACH-related SARs from 2019 to 2024.

- ACH fraud losses surged by 47% between 2021 and 2023.

- 48% of North American fraud executives identified ACH fraud as their top concern.

Introducing TruProtect ACH

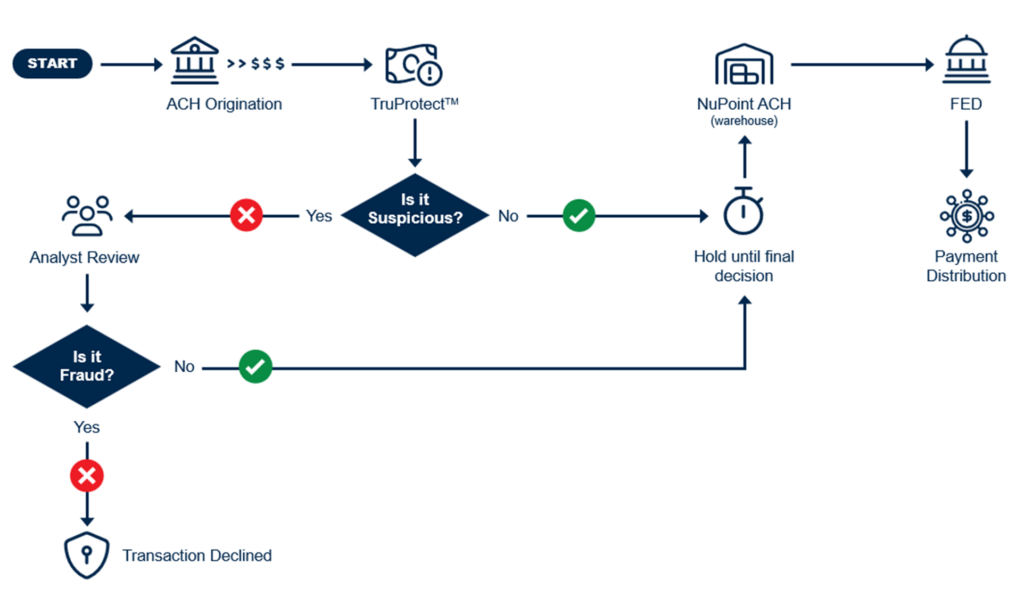

TruProtect ACH is a proactive fraud solution that intercepts suspicious ACH transactions before funds leave the bank. Integrated within CSI’s NuPoint® ACH environment, it combines customizable rules with multi-layered behavioral analytics to identify and block high-risk origination activity, without disrupting your current workflow.

Modern Defense for Today’s ACH Fraud Risks

- Proactive Fraud Interdiction: Flag and decline suspicious ACH transactions before they post, protecting customers from potential harm.

- Unified Case Management: Investigate ACH, wire, card, and AML alerts in one place, reducing investigative silos and streamlining fraud review across departments.

- Customizable Rules Engine: Configure fraud rules to align to your institution’s specific risk profile, effectively identifying high-risk scenarios while minimizing false alerts.

- Comply with Nacha Regulations: Confidently prepare for Nacha’s 2026 fraud monitoring requirements with proactive detection and clear documentation.

- Built-In Workflow: Fully embedded within NuPoint® ACH, TruProtect operates within your existing origination process. Analysts engage only with flagged transactions, streamlining operations without requiring retraining or changes to your current workflow.

See how TruProtect™ ACH empowers your institution to stop fraud before it strikes and stay ahead of an evolving compliance landscape. Request a demo today and discover how easy it is to strengthen your ACH fraud defenses.