Proactive Protection | Intelligent Detection | Trusted Transactions

The Rising Cost of P2P Fraud

Instant payments are now a core element of digital banking, but they’ve also opened the door for rising P2P fraud. Scams are faster, more sophisticated, and harder to reverse, leaving banks and customers alike vulnerable to significant losses. Fragmented fraud tools and manual reviews can’t keep pace with the speed of real-time transfers, creating costly gaps in protection and damaging customer trust. The impact is clear:

- $560M+ in P2P scam claims denied by banks since 2021.

- 1 in 12 banking customers say they’ve been victimized by a P2P scam in the last 12 months.

- 75% of consumers say they would switch to another institution if theirs failed to provide adequate fraud protection.

Introducing TruProtect™ Fraud for SPIN

CSI’s Social Payment Instant Network (SPIN) brings modern P2P payment technology to community financial institutions, with funds clearing in minutes. TruProtect™ Fraud for SPIN adds the real-time fraud defense layer that financial institutions need to stop scams before they strike.

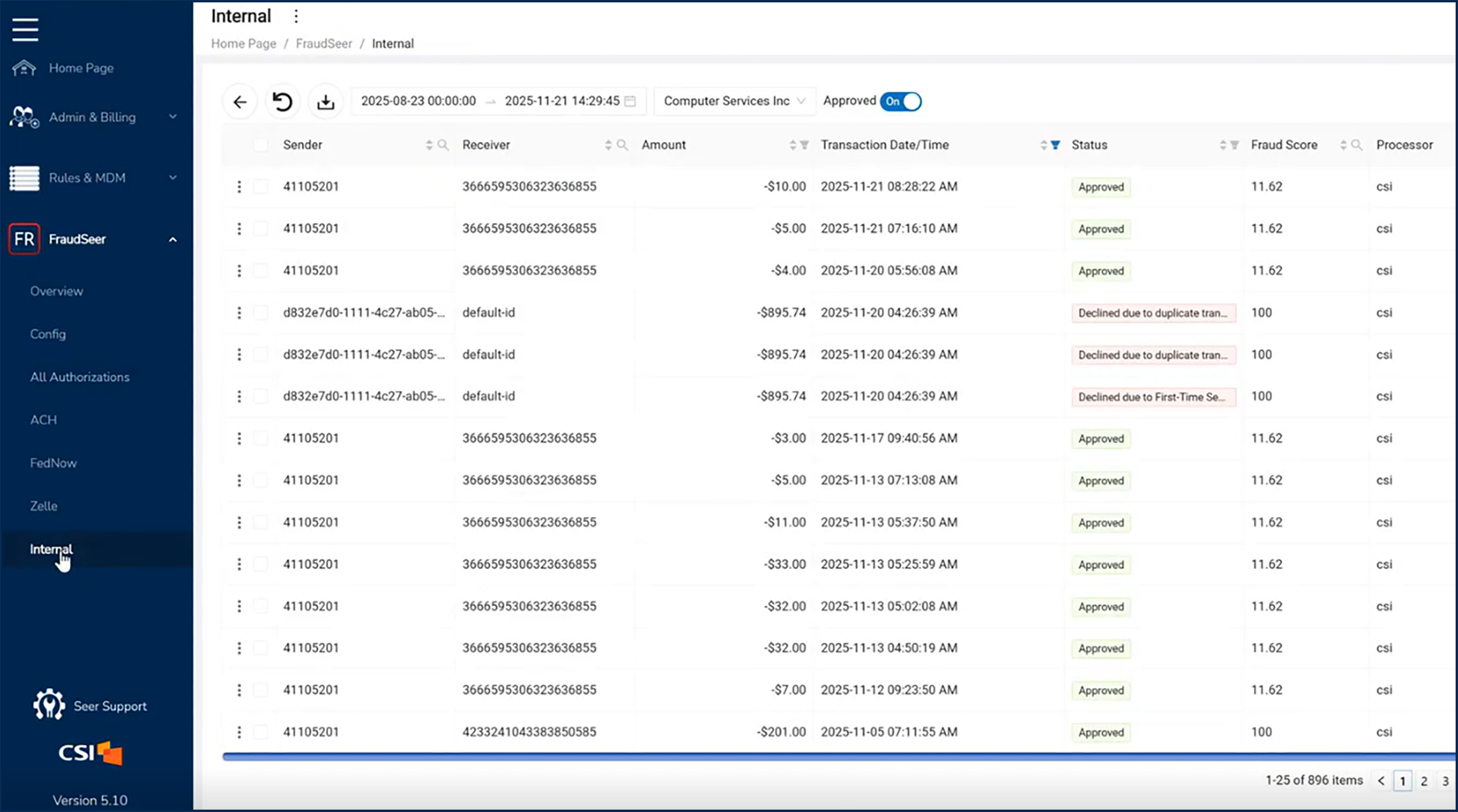

Powered by behavioral analytics, rules-based decisioning, and multi-level anomaly detection, TruProtect delivers adaptive protection that safeguards every transaction and reinforces customer trust.

Protect Customer Relationships with TruProtect Fraud

A single fraud incident can undo years of work building trust. TruProtect Fraud for SPIN helps protect those relationships with real-time, behavior-driven detection that stops suspicious activity before the damage is done.

Protect Every Transaction: Identify and decline suspicious P2P transactions in real time, before losses occur.

Smarter Detection: Harness advanced behavioral analytics to spot anomalies, reduce false positives, and keep legitimate transactions flowing.

Tailored Approach: Customize rules, thresholds, and risk models to align with your institution’s unique fraud profile and customer base.

Unified Case Management: Streamline fraud and AML investigations with an integrated dashboard that gives your team a complete view of risk across all channels.

TruProtect Fraud for SPIN helps you deliver smarter, faster fraud defense, building trust and loyalty with every transaction.

The Future of P2P Fraud Prevention Starts Here

Traditional, reactive fraud systems respond too slowly to protect institutions and their customers.

The future of fraud prevention is proactive. TruProtect Fraud for SPIN lets institutions stop scams at the earliest warning sign, not after the damage is done.

With CSI’s fully integrated, configurable platform, your team can detect and stop fraud instantly, without disrupting legitimate payments or relying on a patchwork of third-party tools. The result: full control of fraud prevention and customer protection from day one.

Discover how real-time intelligence and adaptive analytics can transform your fraud defense strategy. Request a demo today and take the next step in protecting your institution and your customers.