PADUCAH, Ky. (July 11, 2022) – Computer Services, Inc. (CSI) (OTCQX: CSVI) today reported record revenues and net income for the first quarter of fiscal 2023, which ended May 31, 2022.

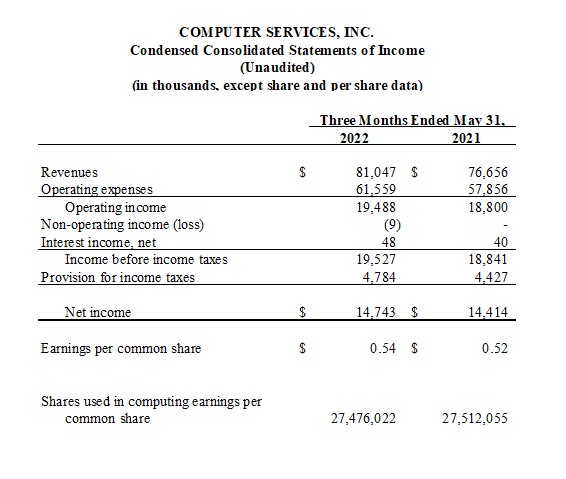

CSI’s revenues rose 5.7% to a record $81.0 million for the first quarter of fiscal 2023 compared with $76.7 million for the first quarter of fiscal 2022. First quarter net income rose 2.3% to a record $14.7 million compared with $14.4 million for the first quarter of fiscal 2022. Net income per share rose 3.8% to $0.54 compared with $0.52 for the first quarter of fiscal 2022.

“CSI’s record first quarter results highlight the continued demand across the board for our product and service lines from our Enterprise Banking and Business Solutions groups,” stated David Culbertson, CSI’s president and CEO. “Our excellent results benefited from new onboarded business, high contract renewals and incremental product sales to existing customers. Additionally, our new business sales momentum and pipeline activity remain strong. We also received excellent customer feedback from our recent in-person customer conference, CX22, where we previewed the next generation of products and services for our Enterprise Banking and Business Solutions customers.

“We remain very positive about CSI’s future. We expect continued growth in revenues and earnings in fiscal 2023 based on current demand from existing customers, added sales from new products and services and new accounts coming online,” continued Culbertson.

First Quarter Results

Consolidated revenues increased 5.7% to $81.0 million in the first quarter of fiscal 2023 compared with $76.7 million in the first quarter of fiscal 2022. The growth in revenues benefited from higher sales in both the Enterprise Banking and Business Solutions groups, including growth in digital banking, payments processing, managed cybersecurity and document delivery revenues. The results for the first quarter of fiscal 2023 included $0.4 million in early contract termination fees compared with $0.6 million in the first quarter of fiscal 2022. Excluding the effect of early contract termination fees, net revenues increased 6.1% in the first quarter of fiscal 2023 compared with the first quarter of fiscal 2022. Early contract termination fees are generated when a customer terminates its contract prior to the end of the contracted term, a circumstance that typically arises when an existing CSI customer is acquired by another financial institution that is not a CSI customer. These fees can vary significantly from period to period based on the number and size of customers that are acquired and how early in the contract term a customer is acquired.

Operating expenses were up 6.4% to $61.6 million for the first quarter of fiscal 2023 compared with $57.9 million for the first quarter of fiscal 2022. The increase in operating expenses was related to higher marketing and travel expenses for CX22, held in the first quarter of fiscal 2023; higher cost of goods sold on higher related payments processing, digital banking, document delivery, and managed cybersecurity revenues; and increased software and equipment expenses that were partially offset by lower personnel expenses due to higher capitalized salaries and lower profit-sharing plan contribution expenses.

Operating income increased 3.7% to $19.5 million for the first quarter of fiscal 2023 compared with $18.8 million for the first quarter of fiscal 2022. The increase in operating income was due to increased payments processing and digital banking revenues that were partially offset by an increase in operating expenses from CX22 and higher cost of goods sold on higher related revenues. Operating margins were 24.0% in the first quarter of fiscal 2023 compared with 24.5% for the first quarter of fiscal 2022.

The provision for income tax was $4.8 million for the first quarter of fiscal 2023 compared with $4.4 million in the first quarter of fiscal 2022. The increase was due to a higher effective tax rate in the first quarter of fiscal 2023 compared with the first quarter of fiscal 2022.

Net income for the first quarter of fiscal 2023 rose 2.3% to $14.7 million compared with $14.4 million for the first quarter of fiscal 2022. Net income per share increased 3.8% to $0.54 for the first quarter of fiscal 2023 on 27.5 million weighted average shares outstanding compared with $0.52 for the first quarter of fiscal 2022 on 27.5 million weighted average shares outstanding.

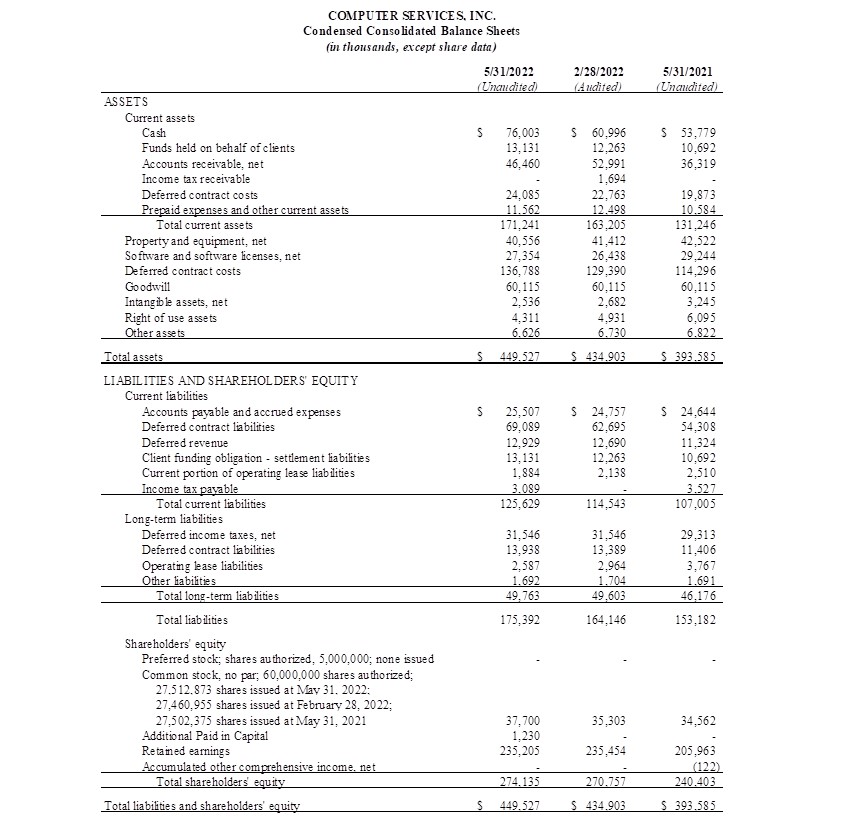

CSI’s cash flow from operations increased 12.8% to $27.5 million in the first quarter of fiscal 2023 compared with $24.4 million in the first quarter of fiscal 2022. Cash and cash equivalents rose 24.6% to $76.0 million as of May 31, 2022, from $61.0 million as of Feb. 28, 2022.

“CSI’s financial position remains very strong with our increased cash reserves and no long-term debt,” continued Culbertson. “We intend to leverage our strong financial position by investing in new product development, software and hardware to support our future growth. We are also focused on investments in new technologies and acquisitions as opportunities arise. We also expect these investments to strengthen our position as a fintech player with market leading services and scalability on demand.”

About Computer Services, Inc.

Computer Services, Inc. (CSI) delivers core processing, digital banking, managed cybersecurity, information technology services, payments processing, document delivery, and regulatory and cybersecurity compliance solutions to financial institutions and corporate customers, both foreign and domestic. Management believes exceptional service, dynamic solutions and superior results are the foundation of CSI’s reputation and have resulted in the Company’s inclusion in such top industry-wide rankings as IDC Financial Insights FinTech 100, Talkin’ Cloud 100 and MSP 501 Top Global Managed Service Providers, for which it ranked second in 2021. CSI has also been recognized by Aite Group, a leading industry research firm, as providing the “best user experience” in its AIM Evaluation: The Leading Providers of U.S. Core Banking Systems. CSI’s stock is traded on OTCQX under the symbol CSVI. For more information, visit csiweb.com.

Forward-Looking Statements

This news release contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. All statements except historical statements contained herein constitute “forward-looking statements.” Forward-looking statements are inherently uncertain and are based only on current expectations and assumptions that are subject to future developments that may cause results to differ materially.

Readers should carefully consider: (i) economic, competitive, technological and governmental factors affecting CSI’s operations, customers, markets, services, products and prices; (ii) risk factors affecting the financial services information technology industry generally including, but not limited to, cybersecurity risks that may result in increased costs for us to protect against the risks, as well as liability or reputational damage to CSI in the event of a breach of our security; (iii) risk factors affecting the United States economy generally including without limitation acts of terrorism, military actions including war, and viral epidemics and pandemics that alter human behaviors, including the COVID-19 pandemic and its effect on our business operations and financial results; (iv) increasing domestic and international regulation imposing burdensome requirements regarding the privacy of consumer data especially consumer financial transaction data of which CSI possesses substantial quantities; and (v) other factors discussed in CSI’s Annual Reports, Quarterly Reports, news releases and other documents posted from time to time on the OTCQX website (www.otcmarkets.com), including without limitation, the description of the nature of CSI’s business and its management discussion and analysis of financial condition and results of operations for reported periods. Except as required by law or OTC Markets Group, Inc., CSI undertakes no obligation to update, and is not responsible for updating, the information contained or incorporated by reference in this report beyond the publication date, whether as a result of new information or future events, or to conform this document to actual results or changes in CSI’s expectations, or for changes made to this document by wire services or Internet services or otherwise.