A bank needs a reliable partnership with its core provider in order to deliver the type of service that keeps customers coming back. But at some point, the relationship between Farmers National Bank in Lebanon, Kentucky, and its core provider became untenable.

“There was no service, no communication,” says Melissa Knight, the bank’s president. “We were just a small fish in a large ocean. I have no doubt that if we were an enormous bank that had an infinite amount of money, we would have gotten a lot of the solutions that we ultimately wanted or needed.”

There’s an expression that states, “Change happens when the pain of staying the same is greater than the pain of change.” Switching core providers is an arduous undertaking for banks, one that requires months of planning and precise execution. But according to Knight, something had to give.

“We were going to die a slow, painful death if we didn’t do something else.”

“This Is How It Should Be”

That “something else” started with an evaluation of different core providers. Knight’s research into CSI included gathering insight from current CSI customers and attending its annual conference, CSI Customer Experience, as a prospect bank.

Knight says the conference helped the Farmers National team think about technology and customer service from a different perspective.

“We all came back from the conference and said, ‘This is how it should be… how it could be,’” she says. “The conference got the ball rolling, and we didn’t look at another core provider.”

“The bank went down Friday night, and was up and balanced by 9:30 Saturday morning… Folks from CSI asked me, ‘Everything went so smoothly and there weren’t any issues. What did you do?’ And I responded, ‘We just did what you told us to do!’”

Melissa Knight

President, Farmers National Bank

Knight says one of the big reasons they chose CSI and its NuPoint® core platform is the ability to deploy new products and solutions without having to pay the hefty implementation fees to which they were accustomed.

“Every single time we wanted to add a feature that seemed fairly simplistic, it cost between $15,000 and $20,000 to implement it, and then $500 a month to run it,” Knight says. “It became a joke.”

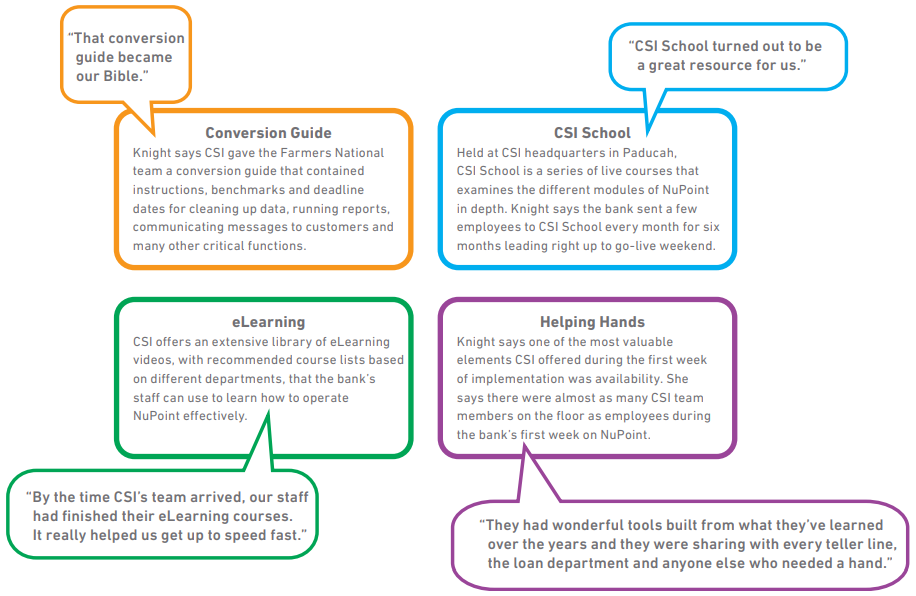

Following their decision to switch to CSI, Farmers National began planning the conversion process.

A Pain-Free Conversion

No two core conversions are the same, and each bank prepares for the conversion process in its own way. Knight said she wanted her bank’s conversion to be a completely transparent process for both customers and employees.

The bank assembled its conversion team in January 2019 to prepare to go live on NuPoint in October. As the team’s first order of business, it established a standing meeting every Thursday from January until launch weekend.

“That two-hour meeting helped us stay organized and proactive,” Knight says. “You have no idea how many meetings you need to have with various groups during a conversion, and we knew we’d be able to talk to CSI during that time, if needed.”

The Farmers National team had been involved in the process of selecting a new provider from the very beginning. Because of that, Knight says her employees went into the conversion with an optimistic attitude and a complete understanding of how the conversion was going to improve the bank.

“Because our employees were so knowledgeable about the change, they did a great job helping customers through it,” Knight says. “They were even selling the new products before we had them.”

To prepare customers for the big change, employees mailed letters, launched a social media campaign to build anticipation and issued a five-part email series sharing details about the upcoming changes to mobile banking, debit card functionality and other crucial services.

The bank entered go-live weekend fully prepared, which made the conversion as smooth as possible.

What Did You Do?

“The bank went down Friday night, and was up and balanced by 9:30 Saturday morning,” Knight says. “Because of that, folks from CSI asked me, ‘Everything went so smoothly and there weren’t any issues. What did you do?’ And I responded, ‘We just did what you told us to do!’”

So how did Farmers National and CSI pull off the perfect conversion?

Knight says 90 percent of the bank’s internet and mobile banking users were registered in the new systems within two to three days following implementation. She also says the bank enjoyed a 23 percent boost in mobile app users just four months after going live, has saved five hours a week scanning documents using CSI’s CenterDoc, and gained an immediate hit with both customers and employees through instant debit card issuance.

With all the new benefits Farmers National Bank and its employees are enjoying from their new core platform, it’s safe to say that the change was well worth any pain felt from converting.