For two consecutive years, most respondents to CSI’s Banking Priorities Executive Survey named digital account opening their top technology priority, with over half (51%) the vote in 2022. It’s easy to guess why – digital account opening done well produces more customers and deposits in today’s heavily digital world.

According to a PYMNTS report, over 75% of new accounts opened over the past year have been via digital channels. For financial institutions, it’s also less expensive and time-intensive, with non-digital accounts reportedly costing on average $138 and digital accounts only $77.

The trick is to create a successful customer acquisition experience that takes a multichannel approach and accounts for consumer expectations. Read on to unpack some of the best practices for digital customer onboarding in banking and methods to establish a value-driven relationship with customers.

Effective digital customer acquisition requires a holistic view of the customer and their onboarding process.

Effective digital customer acquisition requires a holistic view of the customer and their onboarding process.

For a wider view of digital transformation and customer-centric approach, refer to our white paper.

What Is Modern Customer Acquisition in Banking?

Customer expectations have been rising for years, with many looking for experiences that rival the high bar of companies like Apple, Amazon and Netflix. But according to a Celent Survey from March 2021, only a third of banks think holistically across customer touchpoints (digital self-service, contact centers, branches and remote or in-person advisors).

To give potential customers confidence, that must change. Effective digital customer acquisition requires:

- A multichannel approach that is consistent across channels (including the branch) so customers can easily open accounts when, where and how they want

- A seamless user experience from shopping to fulfillment that guides new customers through the shopping process to find the value-added services they need

- More than just a digital application, as effective onboarding that leads to retention also encompasses the first 100 days after account opening

- Intuitive simplicity, as the process should take no longer than five minutes to reduce abandonment

- Backend automation to streamline as much as possible and decrease calls for manual intervention

Customers expect some degree of friction for the sake of security. But optimized account opening minimizes that friction and in so doing, boosts customer acquisition and revenue. It also improves safety and replaces slower and more costly manual processes.

Digital Onboarding Must Consider the Customer Journey

Financial institutions win and lose customers through digital channels. So, as you are honing yours, begin with the end in mind. That end should be fulfillment and value-driven relationships rather than just decreased abandonment rates. Achieving that goal requires an understanding of customer needs and meeting them where they are.

Your digital onboarding process should guide customers to open an account and provide a clear view of your products and offerings. Customizing questions for interest about related products and features can make giving those customers what they want far simpler.

KPIs and the right balance of data and analytics give you a holistic view of your customers and prospects. By using tools like customer journey mapping and reports on abandonment and accounts opened, you can pinpoint moments in the funnel where customers more often abandon the process, after which you can make operational improvements to minimize friction at each bottleneck.

Accounting for the customer journey also requires variety, and a seamless experience across channels. Yes, you must enable end-to-end digital onboarding if customers need or prefer it. But onboarding cannot be limited to digital self-service, and making yourself available to prospects goes a long way.

Digital Account Opening Demands a Simple Customer Experience

According to the same PYMNTs data, the top two reasons people abandon account opening are having to submit too many personal details and not trusting the technology. It makes sense – friction results in abandonment, or at the least frustrated customers with a bad first impression.

Effective digital onboarding challenges outdated IDV and KYC practices by deploying modern technology. There’s always a tradeoff between friction and security, but methods like IP validation and a shift from out-of-wallet questions to one-time passcodes make that trade more palatable. Both ID uploads and biometric authentication also accelerate onboarding and reassure customers.

To further strengthen the customer experience, consider embedding a digital communication platform like live chat or video so customers can receive help without leaving the application. It may sound rudimentary, but enabling applicants to save their progress and resume later or from a different channel make the experience more convenient.

Additionally, features like auto-filling application information for existing customers, linking new accounts to existing ones and offering a variety of accounts without requiring preselected products or funding speed the application along. If acquisition is quick, customers are far more likely to see the process through.

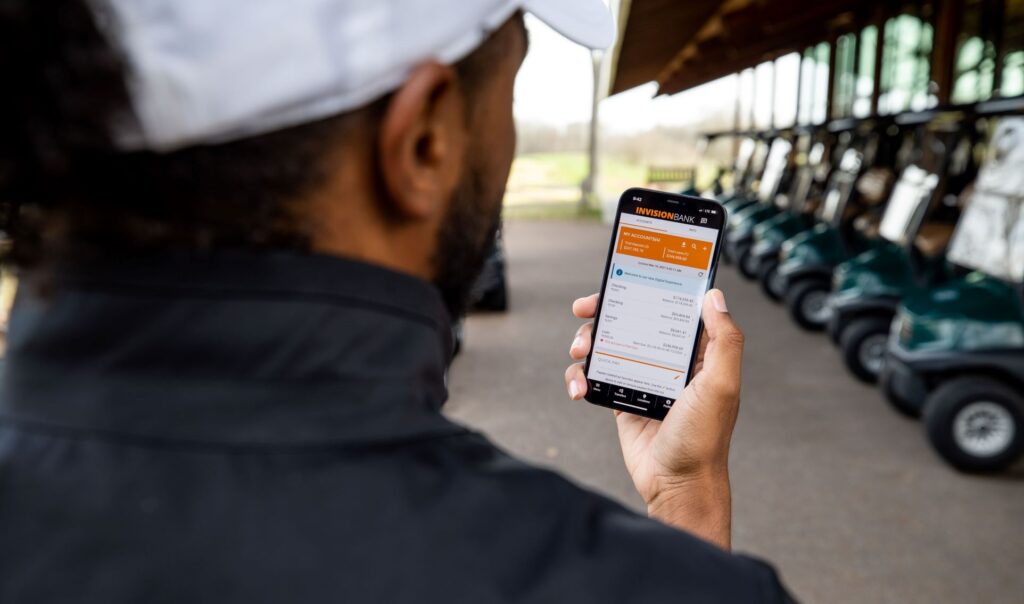

Ideally, customers should be able to follow a link on your web page or within their existing digital banking account to apply, gain approval for and fund a new account in one session.

Ideally, customers should be able to follow a link on your web page or within their existing digital banking account to apply, gain approval for and fund a new account in one session.

Digital Onboarding Solutions Must be Well-Selected and Deployed

In improving your digital onboarding strategy, strive for a solution that simplifies the application process and drives backend efficiency for your institution. Seek to:

- Rethink the funding experience and give customers the options they need

- Create a simple application that automates data entry and removes non-critical data from the process

- Automate backend processes with technologies like auto-decisioning to review customers’ credit and fraud risk

- Seamlessly transition customers to digital banking by taking their credentials and enabling them to begin business with you immediately.

Start with simple products and procedures and make incremental improvements to maintain the best customer experience. Ideally, customers should be able to follow a link on your web page or within their existing digital banking account to apply, gain approval for and fund a new account in one session.

When it comes to the solution itself, choose one that is mobile-responsive, contributes to all the above and includes security and compliance as part of the package. Deployed well, you’ll have more customers enrolling in digital banking, ordering debit cards and becoming engaged with your institution.

Turn Prospects into Active and Engaged Customers

By taking a customer-centric approach to account opening, you’re more likely to create engaged customers that you’ll retain for years to come. Bear in mind that done right, effective customer acquisition should be a blending of in-person and digital onboarding.

Sticking the landing on the technological side widens your digital footprint, makes it easier to reach customers beyond your typical clientele and instills confidence in your capabilities.

For additional tips on fostering customer-centric banking through digital, don’t miss our white paper.

GET MY COPY

Laura Ryan is product manager for NuFund®, CSI’s online account-opening solution. She holds more than 30 years’ experience in the financial technology industry.