CSI is known for hosting world-class events exploring the latest trends and technological advancements in financial services. CX23, held in Phoenix on June 4-7, 2023, was no exception, with thousands of attendees, exciting keynotes and a host of surprises against the Sonoran Desert backdrop.

The Customer Experience Conference explored topics like open banking, enhanced cybersecurity, AI-enabled regulatory compliance solutions and how to maintain a customer-first mentality. It also spotlighted its host city by incorporating local cuisine and music, native artistry, a local charity and outdoor activities like ATV desert tours and hot air balloon rides.

But as always, the focus was connecting and learning from industry experts, so attendees could leave rejuvenated and inspired to compete in today’s tech-driven marketplace. A host of hot topics and themes emerged throughout the three-day event. Below are some of the most noteworthy ones.

Are you interested in being part of the experience next year in San Antonio? Don’t forget to save the date.

CSI’s President and CEO, David Culbertson, discusses the elements of successful transformation at CX23.

CSI’s President and CEO, David Culbertson, discusses the elements of successful transformation at CX23.

Why Elements of Transformation?

Taking inspiration from the forces of nature on display in Phoenix, CX23 delved into the elements. Yes, that exploration included immersive, themed experiences like a culinary journey through all four classical elements. But most critically, the conference focused on the elements of success and change in financial services.

With increasing digitalization and competition in conjunction with the rise of game-changing technologies like AI and growing regulatory expectations, the industry itself is evolving. Meanwhile, many financial institutions are undergoing a steady digital transformation process to stay competitive in the changing market. CSI has even embarked on its own journey of profound transformation.

Those elements of successful transformation – agility, adaptability, strategy, technology and well-considered partnerships – all took the spotlight throughout CX23. While striving to incorporate each element in your approach to staying competitive, it’s worth remembering the following key takeaways uncovered at CX23: Elements of Transformation.

1. The Financial Services Industry Faces Massive Paradigm Shifts

As noted by David Culbertson, CSI’s President and CEO, a significant driver of change is what experts call the Great Wealth Transfer, with an estimated $84 trillion expected to transfer from baby boomers to their heirs in the next 20 years. Younger consumers, who will inherit this wealth, have different values and behaviors, demanding a mix of automated, user-friendly technologies and personalized financial guidance.

Happening in conjunction with the Great Wealth Transfer is a growing list of newer competitors. This tectonic shift demands a fresh approach. Community banks and credit unions took center stage, as they are poised to provide financial guidance and use service-first experience to support these younger generations. New technologies that can start those relationships now also bear mentioning, like parent-authorized debit cards for youngsters.

As institutions strive to stay viable over the next few decades, financial guidance must occur both in the branch and the digital space. Doing so will require a considered blend of branch technologies like interactive teller machines (ITMs) and the right core technology in addition to those digital tools designed for convenience and self-service.

Those that can successfully balance and integrate each element of transformation stand the greatest chance for future success. Therefore, it’s time to initiate conversations with various teams and ensure they are well-prepared for this monumental change.

2. Community Banks Remain Critical in the Financial Ecosystem

While challenges have recently surfaced in the financial industry, including those caused by Silicon Valley Bank, Signature Bank of New York and First Republic, community banks remain a safe and secure backbone of the American financial system. Compared to larger regional banks, community banks have demonstrated superior risk profiles and maintained local decision-making capabilities, making them a reliable choice for customers.

In his keynote, Culbertson highlighted that 94% of the deposits held at SVB exceeded FDIC insurance limits. Meanwhile, the average bank has 41% of deposits that exceed the FDIC’s insurance limits. But the community banks in attendance, on average, had less than 8% of their deposits that exceeded this limit.

So, beyond the underlying crisis lies opportunity, as consumers are increasingly wary of the risks associated with larger banks. Couple this with local decision-making and community banks’ typical risk profiles, and it’s easy to see why the community bank model stands the test of time.

But facing the challenges requires a mixture of resilience and leadership. Which is why CX23 invited Ambassador Sully Sullenberger, famous for his heroic landing on the Hudson, to share what he’s learned about responding in times of crisis. Now is the time for community banks to show their resilience and courage as an example for those customers who see our economy as on the brink of crisis.

3. Collaboration and True Partnerships are the Keys to Long-Term Viability

CX23 served as a vibrant hub of collaboration, the beating heart of the financial services industry. The event ignited the spirit of networking and celebrated partnerships across the industry of those working together to improve the financial system. CSI even announced some of its own exciting new partnerships.

As always, collaboration was one of the primary themes at CX23.

As always, collaboration was one of the primary themes at CX23.

The event also drew attendees together in community outreach to support a local nonprofit organization that aids families battling childhood cancer. In line with its commitment to service, CSI spearheaded the community outreach effort, offering support to Lighthouse Family Retreat—an organization dedicated to providing hope and assistance to these families. This initiative exemplified that ethos of collaboration, uniting attendees from across the country with a noble cause.

One common understanding served as a backdrop: No single organization can tackle today’s host of challenges and rapidly evolving technology alone. However, across sessions from open banking to IT governance, CX23 also emphasized that being and doing everything for everyone is unnecessary.

For instance, institutions who face staffing difficulties can consider outsourcing tasks or modernizing technologies to streamline processes. And in addition to aligning core providers and industry experts with the organizations they serve, opportunities abound for technology partnerships and growing together.

4. Automation and Operational Efficiency are Imperative

While many back-office tasks like data entry are essential for financial institutions, they can strain resources like talent and time. As a result, operational efficiency is a crucial objective in enhancing customer relationships and the employee experience. Necessarily, CX23 highlighted process automation to streamline these previously manual day-to-day tasks.

Not to be confused with artificial intelligence (more on that later), automation runs specific, pre-programmed and repetitive functions to speed up processes with minimal human interaction. For instance, automation could consist of transferring data from one system to another so that it doesn’t have to be done manually. Ultimately, the goal is to help frontline staff work smarter with a stronger sense of purpose.

CX23’s “Automation Spotlight” gave attendees a firsthand look at methods to streamline operations. One highlight was business process improvement. This form of automation focuses on simplifying processes internally or externally to improve a solution or allow for faster implementation.

Another new area of focus was Robotic Process Automation (RPA). Not to be confused with workflow automation, RPA focuses on automating repeatable and predictable tasks using bots to simulate human tasks or eliminate manual steps in a process. Strong candidates for RPA are well-known or documented processes that are highly predictable and stable.

5. The Power of AI can be Unleashed (Safely) in Financial Services

Alongside automation, the air was abuzz with talk of artificial intelligence, as attendees expressed both opportunities and concerns. Differing slightly from automation, AI is machine simulation of human intelligence processes. AI aims to process large amounts of data in ways humans can’t but models human thinking by recognizing patterns and making decisions and judgments.

With the constant influx of data and difficulty knowing how to leverage it to make informed decisions, AI’s potential to revolutionize the financial services landscape (and the tech landscape as a whole) is undeniable. Nevertheless, complex regulations and a need for human customer service mean it should remain a tool for more effective work, not a crutch or replacement of human ingenuity.

With its ability to streamline processes, enhance decision making and unlock new avenues of growth, AI promises to transform the industry as we know it. One of the most intriguing developments was the exploration of generative AI, exemplified by Chat GPT “co-presenting” a session on cybersecurity.

Financial institutions explored the integration of AI in back-office operations, where it showcased its potential to optimize resource allocation, improve operational efficiency and reduce costs. AI-powered algorithms also demonstrated their prowess in detecting fraudulent activities and enhancing risk assessment models, bolstering the industry’s defense against financial crimes. Some notable discussions around the power of AI-driven automation included areas such as compliance monitoring, fraud detection and portfolio management.

6. Open Banking Continues to Hold Promise and Opportunity for Innovation

One of the critical points of emphasis throughout the conference was open banking and how to enable collaboration and strategic technology partnerships—vital aspects of transformation and growth in the financial services industry. The event featured exciting new fintechs with niche offerings and announced the upcoming launch of CSI’s API marketplace and Banking as a Service (BaaS) initiatives.

CX23 explored many modern technologies unlocking success in financial services.

CX23 explored many modern technologies unlocking success in financial services.

As detailed here, open banking enables financial institutions to incorporate new technologies, consolidate data and automate backend processes. It also opens exciting new revenue opportunities like BaaS and Payments as a Service (PaaS).

Whether your institution would like to offer the latest in financial health technology or pursue new revenue streams, effective partnership is essential. Coordination with your core technology provider is key, as they can facilitate relationships with third-party technology providers and keep you updated about what’s available on the market.

At CX23, open banking and BaaS were emphasized as crucial strategies for fostering innovation and improving customer experiences. CSI unveiled new partnerships to enhance the overall customer journey, like its exciting partnership with Echo Health and Anchor Bank that will reduce friction in paying for healthcare. These new types of offerings, and the sponsor financial institutions that support them, have the potential to alter the way customers consume banking services in the future.

7. With Payments, If You’re Not First, You’re Last

Across industry topics, acceleration and agility are the name of the game. Automation and procedural agility are one such area. Speed to market with strategically innovative technologies is another. At CX23, the speed of payments technologies fell under particular scrutiny, as institutions strive to provide their customers with fast and secure payment capabilities to rival any third party.

Since faster payment options have been available for some time from the likes of Venmo, Cash App and the Clearing House’s RTP system, the upcoming launch of the FedNow Service® stands to help all financial institutions compete. This service levels the playing field by enabling community banks and credit unions to provide customers with faster, more convenient payment options, improving customer satisfaction and loyalty. Additionally, the FedNow Service lets financial institutions reduce the costs of traditional payment processing methods. By processing payments in real time, financial institutions can avoid the need to hold onto funds for extended periods, resulting in lower operating costs and improved liquidity.

Dan Baum from the Federal Reserve delivered a session at CX23, overviewing the benefits of FedNow Instant Payments and enlightening attendees about how financial institutions can prepare for and leverage this new payments rail. Institutions that have not already done so should determine which instant payments-enabled solutions they will offer to their business customers, retail customers and internally. Also, they should have a solid understanding of how instant payments will affect internal operations, existing tools and technologies and the overall customer experience.

Throughout FedNow’s phase one, more financial institutions will be able to offer safe and instant payments that meet customers’ expectations. After the roll-out of FedNow, CSI anticipates establishing private and public directories to simplify the payment user experience.

8. It’s Time to Modernize Fraud and AML Programs

The fight against money laundering and financial crimes took center stage at CX23 as the financial industry grapples with an expanding market for illicit activities. That fight is never ending, and the sheer volume of criminal attempts and the complex regulations surrounding them can be overwhelming.

Failure to live up to regulatory expectations to protect your customers’ data can result in fines and reputational damage that cause further financial harm beyond the costs associated with fraud itself. Jaw-dropping figures revealed the magnitude of the challenge, with global financial authorities imposing fines exceeding $10 billion for AML violations in 2020 alone.

Fortunately, anti-money laundering (AML) technologies make preventing criminal activities and adhering to regulations a bit simpler. CX23 focused on modernizing AML programs by combining traditional rules and analytics with next-generation technologies like robotics, semantic analysis, and AI. As mentioned earlier, AI and machine learning adoption in AML processes, such as entity resolution, customer segmentation and automated decision-making can make a significant difference.

9. Cybersecurity Remains an Ever-Present Priority

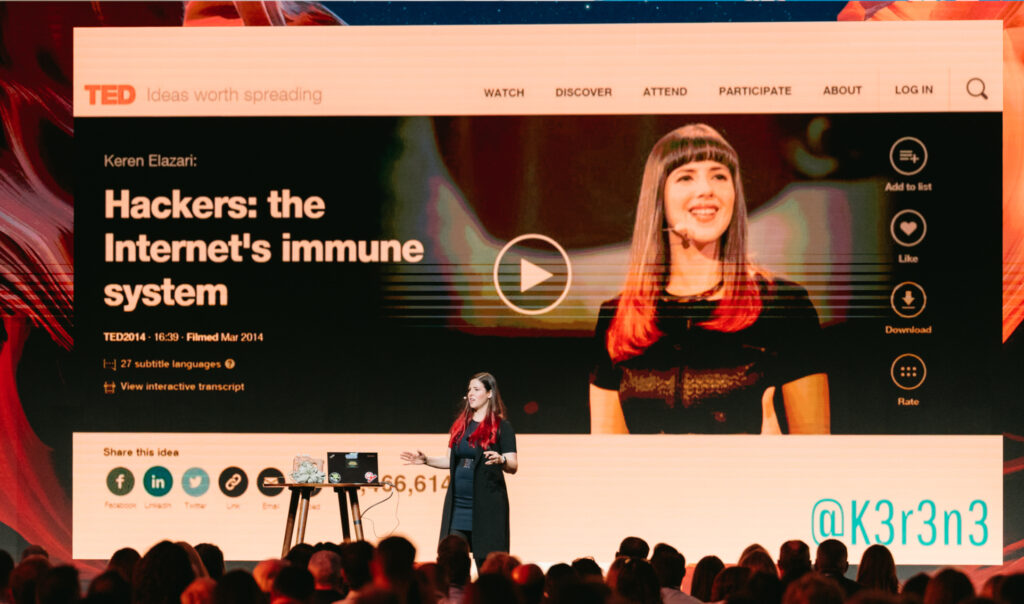

In an era of rampant cyber threats, CX23 left no stone unturned in elevating cybersecurity practices within the financial industry. Ensuring a strong cybersecurity posture is essential for financial institutions to protect their customers or members, data and reputations. With a keynote from world-renowned “friendly hacker” Keren Elazari and sessions highlighting how to keep institutions secure, cybersecurity was front and center at CX23.

World-renowned expert Keren Elazari gives a keynote presentation on cybersecurity at CX23.

World-renowned expert Keren Elazari gives a keynote presentation on cybersecurity at CX23.

The conference dove into insight and recommendations for enhancing cybersecurity, like enabling two-factor authentication, using conditional access, deploying endpoint detection and response (EDR) solutions, conducting security awareness training, validating critical file backups, deploying secure mail gateway solutions and regularly reviewing security event handling procedures.

One session even walked attendees through common tactics used by cybercriminals, including phishing emails and malware housed on a USB drive. With cyber threats constantly evolving, financial institutions should prioritize strengthening their cybersecurity defenses and embrace real-time monitoring and remediation to eliminate threats as they occur.

10. IT Governance and Enhanced Cybersecurity Compliance are Gaining Steam

With the rise of cyber risk, the industry also faces a growing focus on cybersecurity compliance. As explored in this white paper, financial institutions must balance compliance, cybersecurity and IT challenges – all while achieving their strategic goals and delivering results for stakeholders. Key challenges for institutions include exam preparation, staffing, business strategy alignment, executive reporting, cyber insurance and goal tracking.

To address these looming challenges, CX23 unveiled how IT governance is the foundation of a strong IT program and helps align IT and security strategies with business goals while enhancing compliance with ever-changing regulations. The event showcased the benefits of partnering with IT governance consultants for tools, awareness, tracking, support and collaboration. The benefits of streamlined user access reporting were also presented, including maximizing security by validating which of your users have access to specific systems.

In addition to exploring best practices in IT governance and the technologies that can assist, experts in IT governance presented on how some institutions are calling on external industry professionals to function as advisors and provide a deep bench of industry expertise. By working with hundreds of institutions (all with unique business needs), these experts ensure that IT and security strategies align with business goals while helping institutions optimize compliance efforts and navigate the dynamic regulatory landscape.

Save the Date for CX24

CX23 was a transformational event that brought together industry leaders to foster innovation, collaboration and discussion on crucial topics shaping the financial services industry. The event underscored the importance of adapting to change, embracing technologies strategically and building lasting partnerships. Now that it’s in the rearview mirror, it’s time to look ahead.

Save the Date for CX24.

Save the Date for CX24.

So much can change in a year, but as CX24 heads to San Antonio next April, it’ll be sure to provide new insight into the state of financial services. It’s never too early to save the date.

SAVE THE DATE