Each year, CSI’s customer experience conference brings together community bankers as well as cybersecurity and compliance professionals nationwide to explore the technologies and trends transforming the industry. On April 14-17, 2024, the event took place in San Antonio, TX, leaning into authentic relationships and strategic ambition.

In addition to informative sessions and exciting keynotes, the event offered opportunities to network and collaborate. For instance, special celebrations honored the city’s Fiesta at the botanical gardens, provided a grown-up summer camp party and more. Some attendees even kayaked the missions, explored the natural bridge caverns and golfed on the course that’s home to the PGA Valero Texas Open.

Though the event embraced a new flavor that was uniquely San Antonian, the meat of the event explored topics affecting the community banking industry nationwide, with guidance from industry leaders. This blog highlights some of the most critical discussions and takeaways from bankers and thought leaders throughout the conference.

For a deeper dive into today’s industry and the issues most pressing to community bankers, don’t miss CSI’s 2024 Banking Priorities Executive Report.

Defining the Theme: Authentic Roots, Ambitious Pursuits

CX24’s theme, Authentic Roots, Ambitious Pursuits, celebrated the deep roots and authentic relationships that community banks cultivate in their communities. It also emphasized how a balance of relationship-first authenticity and the right investments remain a key differentiator for these institutions.

That theme also reflected its host city. Once a humble Spanish mission, San Antonio has become a dynamic, vibrant metropolis. Its roots have kept it grounded and allowed a lively community with a colorful personality to flourish. CX24 emphasized that like the city around it, community bankers and their technology partners can stay ahead of the times without losing sight of their unique roots and values.

To stay competitive, community and regional banks must be ambitious as they work to deliver the technology that today’s consumers expect. Meanwhile, technology providers must remain grounded in their mission to deliver comprehensive solutions and open technologies that empower them to achieve their distinct goals.

There’s much to consider, like open and digital engagement, modernization with the cloud, next-generation tools to stay secure and compliant and efficiency with automation and AI. But rooted in an effective business partnership that embraces authenticity and ambition, both can accomplish great things. After all, a strong foundation is the key to any far-reaching endeavor.

Lesson 1: There is Continued Opportunity in Community Banking

The financial services industry has faced intense competition for years, with the spread of niche fintechs, industry consolidation and big bank investments in cutting-edge technologies. But for consumers, perceived advantages can come at a cost, particularly in the areas of customer service and providing holistic financial advisory services.

CSI’s CEO David Culbertson highlighted the opportunities in his keynote. He called to mind a recent Wall Street Journal article exploring growing disillusionment with megabanks and how many consumers are migrating back to their local community bank. “This is further proof that our mission to champion community banks is more important than ever,” said Culbertson in his opening statement. He added that consumers want a financial institution where they don’t feel like a number, interest rates are more attractive, and fees are not punitive.

CSI’s recent survey of bankers nationwide reinforced the shared value of these differentiators and the belief that embracing genuine relationships will help community banks serve communities nationwide. An overwhelming majority of respondents (92%) expressed optimism about the future of community banking. To balance relationships with the right technology, strategic partnerships remain imperative.

Lesson 2: Local Communities Need Community Bank Leadership

Along the same lines, much of CX24 emphasized the importance of authentic leadership. For CSI, that leadership means a strategic approach to partner, buy or build new technologies that move the needle. For attendees, leadership is imperative both in their organizations and communities.

On the final morning of the event, professional athlete, author and philanthropist Tim Tebow discussed the complexities of leadership. According to Tebow, long-lasting leadership is rooted in surrounding oneself with the right people and embodying the qualities that uplift them. Additionally, leaders must fight to keep perspective and surround themselves with others who have the passion and compassion to get the job done. “It doesn’t mean we’ll always be right,” he said. “But it gives us a much better chance of success and significance, which is always more important.”

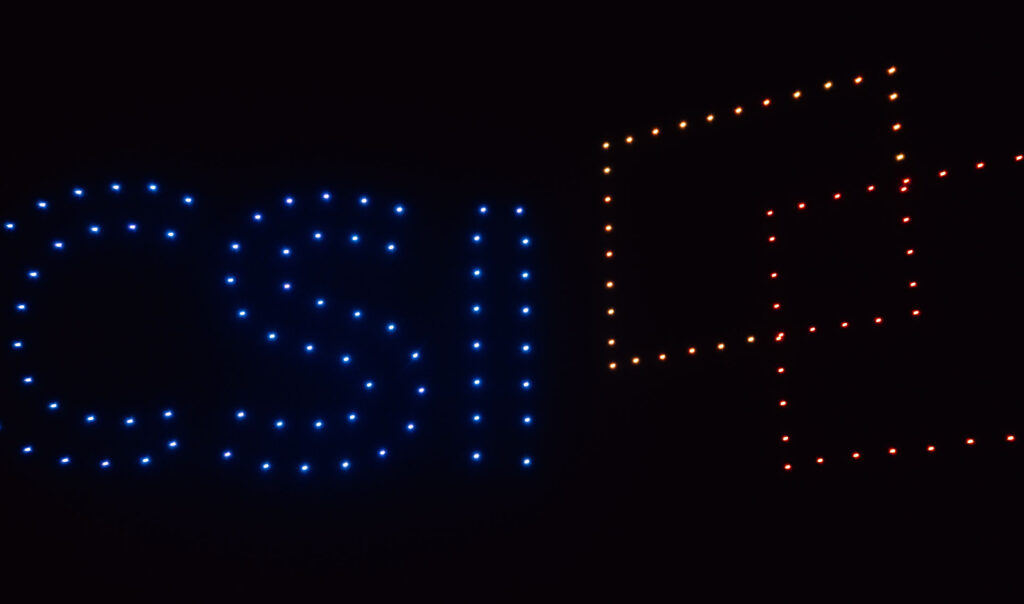

A dazzling drone show summed up the importance of community banking during the event’s final night. Across the country, community banks provide stability, security and opportunity in their communities. Through the right balance of authenticity and ambition, they will continue to help businesses grow, and consumers finance their lives, ultimately creating a stronger foundation for the American economy.

⠀

⠀

Lesson 3: Economic Uncertainty Remains for 2024 and Beyond

Among the many topics discussed throughout the event, the uncertainties of the U.S. economy, including issues of interest rates and inflation, formed a constant backdrop. Dr. Lindsey Piegza, chief economist for Stifel Financial, provided insight into how current data might affect the industry:

Most Impactful Economic Factors

Looking ahead to the remainder of 2024 and beyond, Dr. Piegza explored three main factors driving the economy: consumer behavior, inflation and policy. Although consumers have shown resilience, they are also taking out fewer loans and realigning how they spend their hard-earned cash. Inflation also continues to pose challenges to overall price stability.

The Shift for Consumers and the Market

Despite fiscal stimulus ending and savings dwindling, consumers have found alternative means to maintain spending, including intergenerational wealth transfers (a topic of discussion last year) and increased credit card usage. However, rising costs and debt accumulation are affecting spending momentum. Higher interest rates have also affected the housing market, leading to affordability issues and affecting both buyers and sellers.

The Implications and Impact for Lenders

For lenders, the commercial real estate market presents a significant risk due to looming loan maturities and changes in workspace dynamics post-pandemic. Some economists have stated concern about stagflation – sluggish growth combined with high inflation – which could worsen if the Fed doesn’t act decisively. Experts advise that bankers should diversify portfolios as necessary while monitoring population trends and shifts in work and living patterns. These will shape economic dynamics in the coming months.

Lesson 4: Many Banks Seek Similar Technology Advancements

CX24’s informative breakout sessions included hot topics like evolving the employee experience, combating fraud and how to get the most out of your education and help files. They also narrowed their focus to individual technologies and strategies for success. Among these, topics like digital account opening, small business banking, lending and digital engagement gathered a lot of attention.

⠀

⠀

Efficient Loan Origination Software

Driven in part by CSI’s recent investments in lending technologies, streamlined loan origination garnered a great deal of attention. Although the demand for lending has decreased slightly over the past year, lending remains a significant revenue driver. Innovative platforms that consolidate lending processes and offer more visibility often result in more efficient staff, loans distributed faster and higher return.

Digital Account Opening and Onboarding

Given the state of the economy and a lower demand for loans, community banks also showed a heightened focus on account acquisition and onboarding. That intensified focus on gaining new customers quickly and efficiently reinforced findings from CSI’s Banking Priorities survey, which revealed digital account opening as this year’s top investment, and 52% focusing on customer identity verification. CX24 offered sessions on each, highlighting technologies that can help create a more unified, omnichannel experience with parity across platforms and within the branch.

Improved Mobile Banking

Finally, as consumer demographics shift, there remains a drive to further strengthen digital offerings for consumer and business clients. According to Javelin, Gen Z is a prime target for community banks to grow their customer base, emphasizing the importance of amplifying their digital and mobile apps. 60% of millennials and Gen Z say they would switch banks for a better mobile app. As a result, a robust digital offering is essential.

Lesson 5: Cybersecurity and Fraud Prevention Have Gotten More Complex

No discussion of the industry’s opportunities would be complete without a clear view of the threats and challenges. So, CX24 offered a range of sessions centered on enhancing cybersecurity and fighting financial crimes. Notably, the conference spotlighted the escalating importance of fraud prevention and the growing influence of artificial intelligence (AI) on both sides of the table.

The Promise and Perils of AI in Cybersecurity

In cybersecurity, AI poses both opportunities and its share of risks. While it holds promise for scam detection, AI also makes it easier for bad actors to scale up their efforts and make them more convincing. New risks include falsification of identification documents, the proliferation of phishing schemes on a large scale and audio and video deepfakes to deceive bankers.

How Bankers Can Improve Their Cybersecurity Posture

Beyond constant vigilance, experts emphasized proactive measures, such as data loss prevention (DLP) software, which categorizes sensitive data and enforces organizational policies to mitigate risk. The prevalence of data breaches, predominantly attributed to negligent insiders and cyberattacks, further underscores the critical importance of end-user education in tandem with vulnerability assessments, penetration testing and robust incident response strategies.

The Evolution of Fraud Execution and Prevention

In tandem with these cybersecurity measures, CX24 explored the rising tide of payments fraud, which includes wire transfers, P2P transactions and a return of check fraud. Despite advances such as EMV chips curbing physical card fraud, banks have witnessed a surge in other areas, necessitating heightened vigilance and adaptive strategies. The advent of AI again introduces both challenges and opportunities. AI modeling can evaluate customer behavior and better detect patterns within consumer data to highlight potential risks. Other automatic measures, like temporarily blocking access to new payee setups after a password change, can help discourage fraud.

Lesson 6: Scaling Requires Technology Modernization

Beyond individual products and technologies, advancing customer expectations requires community banks to find effective methods to grow and scale. Two such focus areas include open banking and technology modernization in the cloud. By enabling more integrations with third parties and migrating core processes without disruption, community banks can gain greater security, cost-effectiveness and flexibility.

⠀

⠀

The Continued Shift Toward an Open Banking Ecosystem

As stated by a presenter from research firm Celent, the ecosystem is becoming increasingly open. This model enables banks to push and pull data in real time so that technology providers can build applications and services around a financial institution safely and securely.

Opportunities for open banking lie under such umbrella categories as business process integration, consumer process integration and Banking as a Service (BaaS). Each bank should determine the role they want to play and what the right strategy is for them. They must also consider critical regulatory implications, such as section 1033 of Dodd-Frank, which gives consumers the right to access information about their financial products and services from providers.

Technological Migration to the Cloud

Meanwhile, the public cloud provides numerous potential benefits, including enhanced accessibility, security and scalability. By leveraging third-party vendors’ expertise and resources, institutions can improve their security posture, ensure compliance and respond swiftly to changing business needs. The industry is making a concerted effort to migrate processes to the cloud while ensuring business continuity and minimal disruption.

Save the Date for CX25

CX24 celebrated history, nodded to authentic relationships and spotlighted ambitious innovations steering the banking industry. It revealed how a blend of genuine relationships and strategic ambitions will help community banks further differentiate themselves and take on tomorrow’s challenges. To quote Theodore Roosevelt, “Keep your eyes on the stars and your feet on the ground.”

Next year, CX25 heads to Orlando, Florida from March 30-April 2, 2025. It promises to be another unforgettable experience with another year’s worth of industry developments to explore. Don’t forget to mark your calendar.

In the meantime, read up on more of today’s top banking issues and trends in our 2024 report.

Explore now